Table of Contents

ToggleInside TCG Labs Soleil’s $400M Bet on Focused Biotech

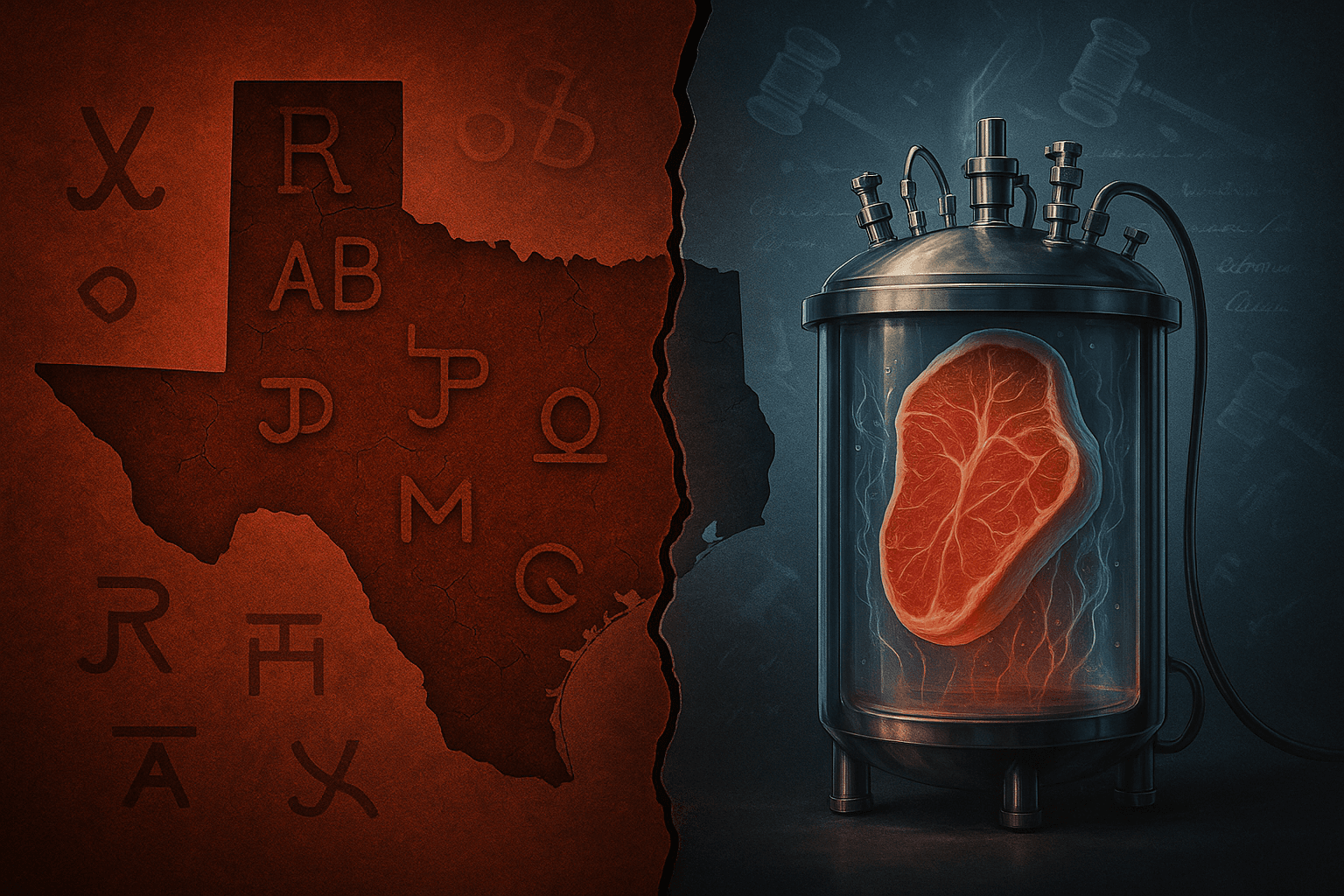

On 24 July 2025, TCG Labs Soleil, the biotech venture‑studio launched under The Column Group umbrella, quietly unveiled a second $400 million fund, matching its inaugural raise in 2024. That rightly triggered headlines—but what matters far more is how the firm is deploying capital. Its strategy: build dozens of micro‑startups, each centered on a single therapeutic asset, develop it through proof‑of‑concept, and exit swiftly. The implication: a subtle but fundamental shift in how biotech innovation—and venture capital—operates.

Why Even Well‑Seasoned Investors Should Lean In

The biotech industry has long revolved around platform plays—companies that carry multiple drug candidates, diversify pipeline risk, and morph pivot‑style when one program fails. TCG Labs Soleil flips that model. Instead, each of its portfolio companies is hyper‑focused on one asset: a biologic, cell therapy, or immunotherapy engineered by top scientists, shepherded through early development, and sold or licensed when value peaks.

The rationale is clear: minimise time, reduce cost, and avoid organizational bloat. If the asset fails, the company is folded; if it succeeds, it becomes a clean, attractive acquisition play. That allows capital efficiency and faster decision‑making, traits executives boast when describing the fund’s architecture.

Detail: The firm now boasts ten portfolio companies, each tackling indications ranging from oncology to immune and cardiometabolic diseases. The companies are named after San Francisco streets—a nod to its base in South San Francisco—and each operates independently under an R&D umbrella named Soleil (Sun in French), staffed by an internal scientific leadership team echoing the model of internal drug R&D.

Launch #2: Doubling Down with Another $400M

This second capital infusion, matched in size to the first, takes TCG Labs Soleil’s total war chest to $800 million within just one year. The timing and scale are instructive: in a venture market widely labelled as cooling, the firm is doubling conviction in the same playbook.

Peter Svennilson, Managing Partner, calls it a capacity‑builder: “this model gives us the flexibility and control to invest decisively in the highest‑potential single‑asset programs… whether through in‑house development or an early strategic transaction.” Jin‑Long Chen, the former Amgen research head and NGM Biopharma founder now CEO of Soleil, underlines that with several programs nearing clinic readiness, the raise reflects both pace and productivity.

The Model in Detail: One Asset, One Company, One Outcome

1. Asset Sourcing & Selection

TCG Labs Soleil acquires assets either entirely generated in‑house or in‑licensed from external innovators. For instance, Juri Biosciences, one of its portfolio companies, licensed a development‑ready KLK2 × CD3 T‑cell engager from Shanghai’s EpimAb Biotherapeutics, targeting metastatic prostate cancer in a deal worth up to $210 million in biobucks.

That deal is instructive: the asset was in clinical readiness, making Juri a clear candidate for fast progression to proof-of-concept trials, without the need to build a full drug‑development infrastructure from scratch. And EpimAb, based in Shanghai, suggests an asset pipeline that spans beyond US borders—a nod to a global deal flow.

2. Integrated R&D & Venture Execution

Unlike the standard LP-backed venture model, Soleil is an evergreen R&D hub that supports all portfolio companies centrally. That means science leadership, protocol design, toxicology packages, CMC development, and IND submission are managed centrally, while each micro‑company remains nimble.

Soleil’s footprint now spans San Francisco and Shanghai, allowing for cross‑border execution as well as access to global scientific networks to source assets.

3. Capital Efficiency & Speed

By focusing resources on one asset per company, the model invests less capital per entity (relative to platform startups) and moves fast. With potentially hundreds of micro‑companies in pipeline, the firm can spread risk while enabling multiple quick value inflection points.

When proof‑of‑concept is achieved (e.g. Phase I/II success), each asset becomes ripe for strategic partnership, licensing or trade sale—particularly to big pharma, which prefers small, clinical‑stage programs with clear risk/reward profiles.

4. Exit Focused Design

The goal isn’t long-term standalone growth; it’s early exit. Much like venture studios for tech, the payoff comes when assets are acquired. That creates tidy return profiles: fewer interdependencies between assets, optimized valuation timing, and selective correlation to scientific success.

Why This Model Deserves Attention—and Scrutiny

A. Is Biology Too Messy for Micro‑Companies?

Critics argue that early‑stage biopharma is inherently unpredictable, and platform flexibility allows pivoting to backup assets. Soleil’s approach offers none. If Asset A fails, Company A dissolves. The firm needs many more hits to win.

However, data from the first ten launches and Juri’s licensing suggests sourcing high‑quality assets—often mid‑ or late preclinical—is its edge. Deep involvement from the early stages may preempt costly late failures.

B. How Do You Maintain Scientific Quality at Scale?

Running ten or more micro‑startups simultaneously demands consistent scientific leadership. Soleil centralizes R&D leadership but spots risk in dilution if scientific bandwidth doesn’t scale. Jin‑Long Chen and TCG’s internal team will need to recruit star-level talent to manage expanding portfolios.

C. Valuation Arbitrage: Timing and Big Pharma Appetite

When to strike? Exiting too early yields less return; too late increases risk. The ideal window is pre‑Phase II when big pharma is willing to invest significant downstream dollars. But market dynamics shift—competition, valuation trends, appetite for licensing change over time. TCG’s success will depend on timing each exit precisely.

The Macro Stakes: Why Investors & Founders Should Care

TCG Labs Soleil’s scaling says something bigger: that focused biotech studios can be viable alternatives to broad‑platform startups. For investors, it offers potential diversification across many assets, each with a low capital threshold, shorter timelines, and clearer exit paths.

For biotech entrepreneurs, it offers a new route: rather than build a large team, raise $100M series A for multiple assets, founders can partner with a studio to push a single programme to proof and cash in.

With $800M behind it already and a pattern of deals beginning to emerge, Soleil could redefine venture‑backed biotech formation in the US—if they can show consistent portfolio outcomes.

Early Performers: What We Know So Far

- Juri Biosciences (prostate cancer T‑cell engager): in‑licensed from EpimAb, now strategic deal material.

- Others: unspecified therapeutic areas (cancer, immunology, cardiometabolic disease) are moving toward the clinic, though details remain confidential.

We do know the firm has already ten portfolio companies, each named after San Francisco streets—but we don’t yet have public clinical data beyond Juri’s licensing milestone.

Competitive Context: Who Else Is Trying This?

- Platform VCs like Omega Funds and Deerfield are doubling down with large biotech‑focused funds—Omega raised ~$647M, Deerfield over $600M. But their investments still largely fund platform companies.

- Other biotech studios exist—long‑standing approaches like ARCH in the UK or i3 in Europe—but in the US this earliest scale of a fully integrated venture‑lab dedicated to single assets is rare.

Final Take: A Structural Disruption, or Architectural Gimmick?

TCG Labs Soleil may not yet have shaken the entire biotech ecosystem—but in raising a second $400M in under 12 months and visibly building companies, it’s making a statement. If even a few of its portfolio programs lead to high‑value transactions, the model could become a blueprint: lean, focused, funding‑efficient, and structured for exit from inception.

This isn’t venture capital as usual. It’s venture capital as incubator, a startup studio built for biology. The real test now: can it scale scientific quality as fast as capital? The coming 12–18 months—particularly clinical data and deal flow—will tell.