Late on Monday night in California — 10:30 p.m. PT on October 20 — Galapagos said it intends to wind down its cell-therapy business after a months-long sale process failed to produce a viable buyer. The decision lands as Europe wrestles with an uncomfortable truth: autologous cell therapies are scientifically dazzling but economically awkward — especially under European rules, budgets and labour protections.

Table of Contents

ToggleWhat happened — and why it matters

Galapagos’ board (with Gilead-appointed directors recusing) approved an intention to wind down its CAR-T and T-cell therapy operations, subject to works-council consultations in Belgium and the Netherlands. The plan would affect ~365 employees across Europe, the US and China; shutter sites in Leiden, Basel, Princeton, Pittsburgh and Shanghai; and carry €100–€125m of operating costs (Q4-2025 through 2026) plus €150–€200m of one-off restructuring in 2026. Management said the sale process yielded only “limited” non-binding offers and none that would reasonably support the unit’s future.

The choice is striking because Galapagos bet on a decentralised, point-of-care model after acquiring CellPoint and AboundBio in 2022 — aiming for seven-day “vein-to-vein” times and fresh (non-cryopreserved) product. In 2024–2025, the company showcased early CD19 CAR-T data (GLPG5101/5201), a France manufacturing tie-up, and even partnered with Adaptimmune to try the platform on a solid-tumour TCR therapy. The science wasn’t the immediate problem; capital and industrialisation were.

Two weeks ago Galapagos disclosed it had non-binding offers (mostly from financial investors) and targeted an early-November decision. The answer arrived sooner — and harsher.

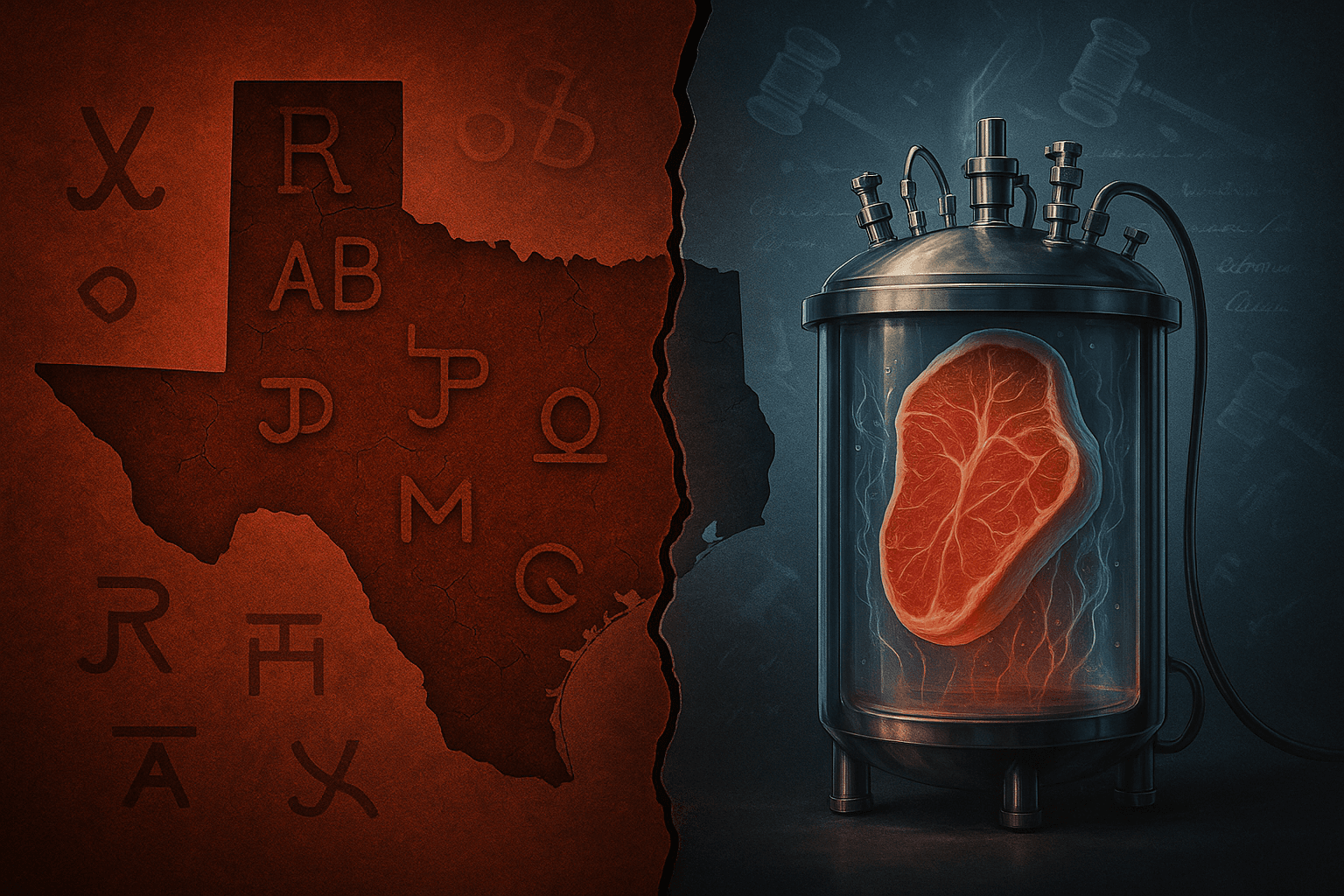

Europe’s CGT paradox: strong science, thin commercial oxygen

Europe has plenty of CGT science and a growing approvals base, but the commercial runway remains short. Peer-reviewed and regulatory analyses tally ~18–25 authorised ATMPs in Europe (depending on timing and withdrawals), with most approvals on the gene-therapy side rather than cell therapy — and real-world availability varies widely across member states.

Uptake for CAR-T is shaped by the number of certified treatment centres, referral logistics and country-specific reimbursement. In EU-4 + UK, payers have leaned on outcomes-linked schemes — staged payments in Italy and Spain, coverage-with-evidence in England and France, and rebate-style risk-sharing in parts of Germany. Good policy — but it embeds data-collection friction and cash-flow uncertainty for manufacturers.

Then there is the price stack. Literature and policy reviews peg list prices near €300k–€350k for approved CAR-T therapies, with total episode costs often €400k–€500k once a long hospital stay, CRS management and follow-up are counted. Hospitals themselves may lose money per case under some payment systems. Europe has been unwilling to chase US-style pricing, and outcomes-based contracts delay receipts — facts that investors now price in.

The “point-of-care” promise meets Europe’s regulatory reality

Galapagos’ thesis was elegant: make cells near the patient, avoid cryo logistics, cut vein-to-vein times to a week, and perhaps reduce bridging chemo and inpatient days. But distributed manufacturing multiplies regulatory and quality challenges: each node sits under EU GMP, Qualified Person release and site inspections; deviations are harder to harmonise; digital batch records and analytics must be robust across hospitals. Advocates are proposing new QMS models and “control-site” supervision, but Europe hasn’t yet standardised this at scale.

One European policy quirk also looms large: the Hospital Exemption (HE). HE allows certain ATMPs to be prepared for individual patients in accredited hospitals without central EU marketing approval. It expands access — but can blunt the incentive to build expensive commercial supply chains if competing hospital-made therapies are available locally. Regulators and clinicians are actively debating how to tighten and harmonise HE without crushing innovation.

Follow the money: when capital moves, strategies follow

The macro picture has turned against capital-hungry CGT. Sector trackers show only a handful of CGTs clearing the $1bn revenue bar so far, while fund-raising for new CGTco’s has cooled in 2025 relative to the post-pandemic peak. Meanwhile, investor attention has chased obesity drugs, compressing risk budgets for complex manufacturing plays. In that context, the lack of a credible bid for Galapagos’ unit looks less like a scientific verdict and more like a market-structure call.

It isn’t just one company. Novo Nordisk shuttered its cell-therapy research unit last week amid broader restructuring — a reminder that even giants are pruning CGT exposure when returns look distant.

What the wind-down signals for Europe

1) Decentralised CGT needs a common rulebook. Europe’s GMP framework was designed for central plants, not dozens of hospital-adjacent suites. Without clear, pan-EU standards for digital batch records, release testing, chain-of-identity and remote oversight, decentralised models will continue to look operationally risky to boards and insurers.

2) Payment models help access but strain cash conversion. Outcomes-based and staged-payment contracts are laudable — and politically necessary — yet they push working capital onto manufacturers. For venture-backed CGT developers, that is a hurdle to scaling, not an accelerant.

3) HE needs guardrails and bridges. If hospitals can legally produce bespoke ATMPs, commercial players will hesitate to invest in industrial-scale capacity unless there is interoperability (e.g., pathway from HE to central authorisation) and procurement clarity. European scientific bodies are already urging legislators to refine HE — Galapagos’ exit will add urgency.

4) The buyer universe is narrower than it looks. Even before the wind-down, Reuters reported financial investors (not strategics) circling the assets. That hints at value-dislocation: IP and equipment are portable; talent and qualified sites are not. In Europe’s labour systems, works-council processes further shape timing and options.

The science didn’t fail; the plumbing did

For all the scepticism, the underlying biology progressed. Galapagos reported encouraging early data for GLPG5101 and explored solid-tumour TCR manufacturing with Adaptimmune (whose first MAGE-A4 product, TECELRA/afami-cel, won US accelerated approval last year). But with pivotal trials years away and a decentralised network to stand up country-by-country, capital discipline won the debate.

If you run a European CGT startup, read this as a checklist

- Design for reimbursement first. Map your target countries’ OBR or CED mechanics into your clinical endpoints and follow-up windows. Payment schedules that match your expected time-to-response will matter as much as your objective response rate.

- Assume you must centralise early — then decentralise with proof. A central hub can simplify initial QP release and quality oversight; only migrate steps to hospitals when you can prove equivalence and cost savings to payers and regulators.

- Exploit HE, don’t depend on it. Use HE to generate datasets and real-world evidence, but plot a path to an EU marketing authorisation (or a multi-country procurement framework) to avoid being stranded as a hospital-only service.

- Build cash-flow buffers into contracts. Where payers insist on staged payments, negotiate milestone timings (eg, CR at 3 months; survival at 12) and ensure working-capital support from lenders or partners.

- Pick indications with rapid, measurable outcomes. Europe’s schemes reward objective, early readouts; slow-maturing signals make staged payments tougher and widen the financing gap.

The near-term watchlist

- Works-council outcomes and asset sales. Galapagos says it will consider bids for all or part of the unit during the wind-down. Investors should watch for equipment/IP transfers to CDMOs or hospital consortia — an implicit vote on the future of decentralised manufacturing in Europe.

- EU policy on Hospital Exemption. Professional societies and transplant groups are pushing Brussels for clearer HE rules in the pharma-law overhaul. Expect proposals that stress safety, interoperability with central approvals and data standards.

- Centre capacity and cross-border care. IQVIA’s analyses highlight how much centre numbers and referral processes govern uptake. France, Spain and Germany have outperformed on adoption; the UK has relied on the Cancer Drugs Fund as a de-risking bridge.

- Solid-tumour cell therapy economics. Adaptimmune’s early sales for TECELRA underscored how hard solo launches can be, even with an FDA approval. That dynamic, plus Europe’s payment discipline, will shape any future wave of TCR-T and tumour-infiltrating lymphocyte products.

Bottom line

Galapagos’ retreat is not a verdict on cell therapy’s future. It’s a referendum on how and where to industrialise it. Europe excels at discovery and trials, and it is experimenting with fair, outcomes-linked payment. But until the region harmonises decentralised GMP, clarifies the Hospital Exemption’s role, and narrows the cash-conversion gap for manufacturers, the continent will keep seeing great science — and more corporate caution.

For now, Galapagos is choosing the cleaner balance sheet over the longer bet. In today’s market, that is a perfectly rational decision. Whether it is strategically optimal for Europe is the more interesting question.