On a cold Tuesday in early January, Amgen quietly made one of the more revealing oncology bets of the new year: it agreed to acquire Oxford-based Dark Blue Therapeutics in a deal valued at up to $840mn.

The headline number is attention-grabbing. The subtext is more interesting.

Dark Blue does not have a drug on the market. Its lead asset, DBT 3757, is still in IND-enabling studies — the final preclinical work needed before human trials. And Amgen has not disclosed how much cash is changing hands upfront.

So what is Amgen really buying?

A mechanism — and a growing corporate conviction — that the next wave of cancer medicines will not just block bad proteins. They will remove them.

Table of Contents

ToggleAML is still a numbers game that patients tend to lose

Acute myeloid leukaemia (AML) is not rare enough to ignore, and not common enough to attract the mass-market optimism that surrounds, say, obesity drugs.

In the US, the American Cancer Society estimates that 22,720 people will be diagnosed with AML in 2026, and 11,500 will die from it. SEER data puts the overall five-year relative survival at 32.9 per cent.

There has been genuine progress. A widely used regimen for patients who are older or cannot tolerate intensive chemotherapy — venetoclax plus azacitidine — delivered a median overall survival of 14.7 months, versus 9.6 months for azacitidine alone, in long-term follow-up of the VIALE-A study. But AML remains a disease where remission is often temporary, resistance is common, and “better than before” still leaves plenty of room for “not good enough.”

This matters because it explains why big pharma keeps funding new biology in AML even when the commercial story looks messy. When the baseline is so bleak, a drug that reliably extends survival — or turns relapsed disease into something more manageable — can justify real investment.

What Dark Blue is selling: switching off leukaemia’s transcription machinery

Dark Blue’s pitch is a targeted protein degrader designed to eliminate MLLT1 and MLLT3 (also known as ENL and AF9). These proteins are not household names, even within oncology. They are better thought of as part of the cell’s “gene-expression engine”: both have been described as integral components of the super elongation complex (SEC), which helps drive transcription — the process that turns genes into active instructions.

In certain acute leukaemias, this machinery becomes a dependency. Chromosomal rearrangements involving KMT2A (MLL) define a biologically distinct subset of acute leukaemia, and common KMT2A fusion partners include MLLT3 and MLLT1. The result is an aberrant transcriptional programme that helps malignant cells keep behaving like malignant cells.

Dark Blue’s lead candidate, according to the company, is designed to degrade MLLT1/3 proteins in the SEC, with preclinical activity across a range of leukaemia models. The promise is not subtle: remove the dependency, shut down the programme, and you may get broader and more durable responses than you would by hitting a downstream pathway.

That is a big “may.” It is also precisely the sort of “may” that a company like Amgen can afford to fund — especially when it comes wrapped in a structure that shifts risk into milestones.

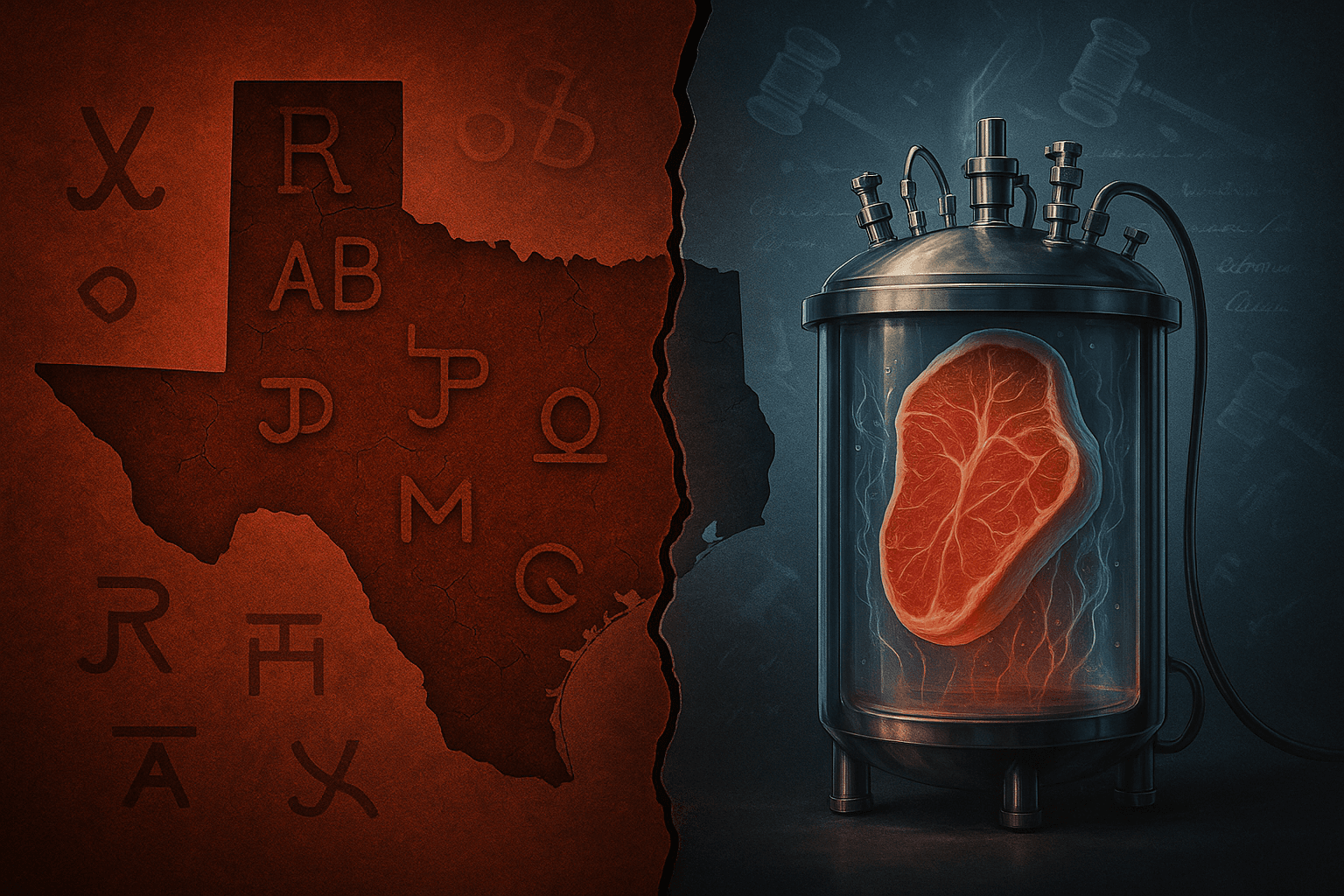

Why protein degraders keep winning budgets

Targeted protein degradation (TPD) has become one of the more powerful ideas in drug discovery for a simple reason: it offers a way to go after targets that are hard to inhibit.

Traditional small molecules are, at heart, blockers. They sit in a pocket and stop a protein working. But plenty of disease-driving proteins — particularly those involved in transcription — do not offer neat pockets. TPD, by contrast, aims to selectively eliminate disease-causing proteins by hijacking the cell’s own disposal systems.

This shift — from blocking function to removing the protein — is not just scientific fashion. It changes what is possible:

- You can target scaffolding proteins and “undruggable” biology. Reviews of the field note that degraders have been pursued explicitly to expand reach to proteins previously inaccessible to conventional inhibitors.

- You may overcome certain forms of drug resistance. When a protein is gone, the cell cannot simply “outcompete” the inhibitor by turning up expression. That does not solve every resistance problem, but it widens the playbook.

- You can build combination logic early. Amgen itself emphasised “single-agent and combination use” as part of the rationale for Dark Blue’s programme.

The other reason degraders are winning budgets is less romantic: deal economics.

A headline value like “up to $840mn” is often best read as an option price. The “up to” is doing heavy lifting. Dark Blue’s own release says the valuation includes upfront and future milestones. BioPharma Dive notes the companies did not disclose the upfront amount.

In practice, this structure lets big pharma buy early science without paying the full price of certainty. If the drug fails in early clinical testing — which many preclinical oncology assets do — the acquirer does not write the remaining cheques.

That is a sensible way to finance high-risk biology. It also helps explain why degraders, as a modality, are attractive inside large R&D organisations: once you have the tools and know-how, you can place multiple shots on goal.

This is not Amgen’s first bet on induced proximity — it’s a tightening of the theme

Amgen is presenting the Dark Blue acquisition as an extension of its strategy in targeted protein degradation and leukaemia. The company’s recent history supports that.

In 2022, it signed a collaboration with Plexium focused on discovering molecular glue degraders, with Plexium eligible to receive over $500mn in milestones plus royalties if options are exercised. Around the same time, Amgen also struck a deal with Arrakis to develop “targeted RNA degraders,” including a $75mn upfront payment for initial programmes.

These are not identical technologies. But they share a common philosophy: induced proximity — using a multispecific molecule to bring a target together with the cellular machinery that can modify or destroy it.

Dark Blue, in that sense, is less a detour and more a consolidation: a way to bring a specific “first-in-class” AML hypothesis directly inside Amgen’s research organisation.

The hard truth: clinical proof is still the scarce commodity

For all the excitement, targeted protein degradation is still in its proving phase.

Yes, the pipeline is maturing. A 2025 review notes that Arvinas’ oral PROTAC ARV-110 is in Phase II, and ARV-471 has advanced to Phase III. But those examples also underline the point: after years of hype, the field is only now pushing its most visible assets into the kinds of trials that settle arguments.

The science itself brings challenges. Reviews stress that TPD faces hurdles around drug properties and rational design — in plain terms, making these molecules potent, selective, safe, and deliverable is hard. Bigger molecules can mean tougher pharmacology, and off-target degradation is a risk that needs careful clinical monitoring, not just elegant chemistry.

And in AML specifically, biology is never “one target, one disease.” AML is a collection of subtypes defined by genetics, age, fitness, prior therapies, and more. Even the current standard for older or unfit patients comes with trade-offs: in VIALE-A follow-up, thrombocytopenia and neutropenia were among the most common adverse events. Any new mechanism will eventually be judged not only on response rates, but on whether patients can stay on treatment long enough to benefit — and whether combinations add efficacy without collapsing tolerability.

That makes Dark Blue’s promise — broader, durable responses, potentially as a backbone for combinations — both attractive and demanding. The burden of proof will be high.

So why buy now?

Because timing matters. If you believe a mechanism could work, the cheapest moment to secure it is before human data arrives — and before competitors can bid the price up.

Amgen’s own framing is blunt: it sees an “urgent need for new mechanisms” in AML and wants to “invest early in rising medicines for novel therapeutic targets.” In other words: if the biology is right, waiting is expensive.

There is also a geographical footnote worth noticing. Dark Blue is part of a wider pattern of US buyers shopping for UK science, particularly in areas where academic discoveries can be converted into platform-like drug programmes. The UK has been good at generating targets; less good at funding the long, costly clinical march. Big US groups are happy to play the other half of that equation — as long as they can do it with milestone-heavy contracts.

The bet behind the bet

For the reader, the most useful way to interpret the Dark Blue acquisition is not as a verdict on DBT 3757. It is too early for that.

It is a signal about what large pharma believes the next decade of oncology requires:

- More mechanisms, earlier — and a willingness to pay for preclinical conviction.

- More shots on difficult targets — especially the transcriptional machinery that underpins aggressive cancers.

- More optionality — financed through deals where “up to” is not marketing fluff, but a risk-management tool.

If targeted protein degraders keep winning budgets, it is not because the industry has run out of ideas. It is because — in diseases like AML — the industry is finally paying for ideas that are bold enough to match the problem.