On February 9, Eli Lilly agreed to buy Orna Therapeutics for up to $2.4bn in cash, betting that one of biotech’s most powerful treatment ideas — CAR-T cell therapy — can be delivered inside the patient’s body, instead of being built in a factory-like process outside it.

If that sounds like a technical tweak, it is not. It is a direct attempt to solve the problem that has kept CAR-T both famous and rare: the therapy works, but it is hard to make, hard to deliver, and hard to scale.

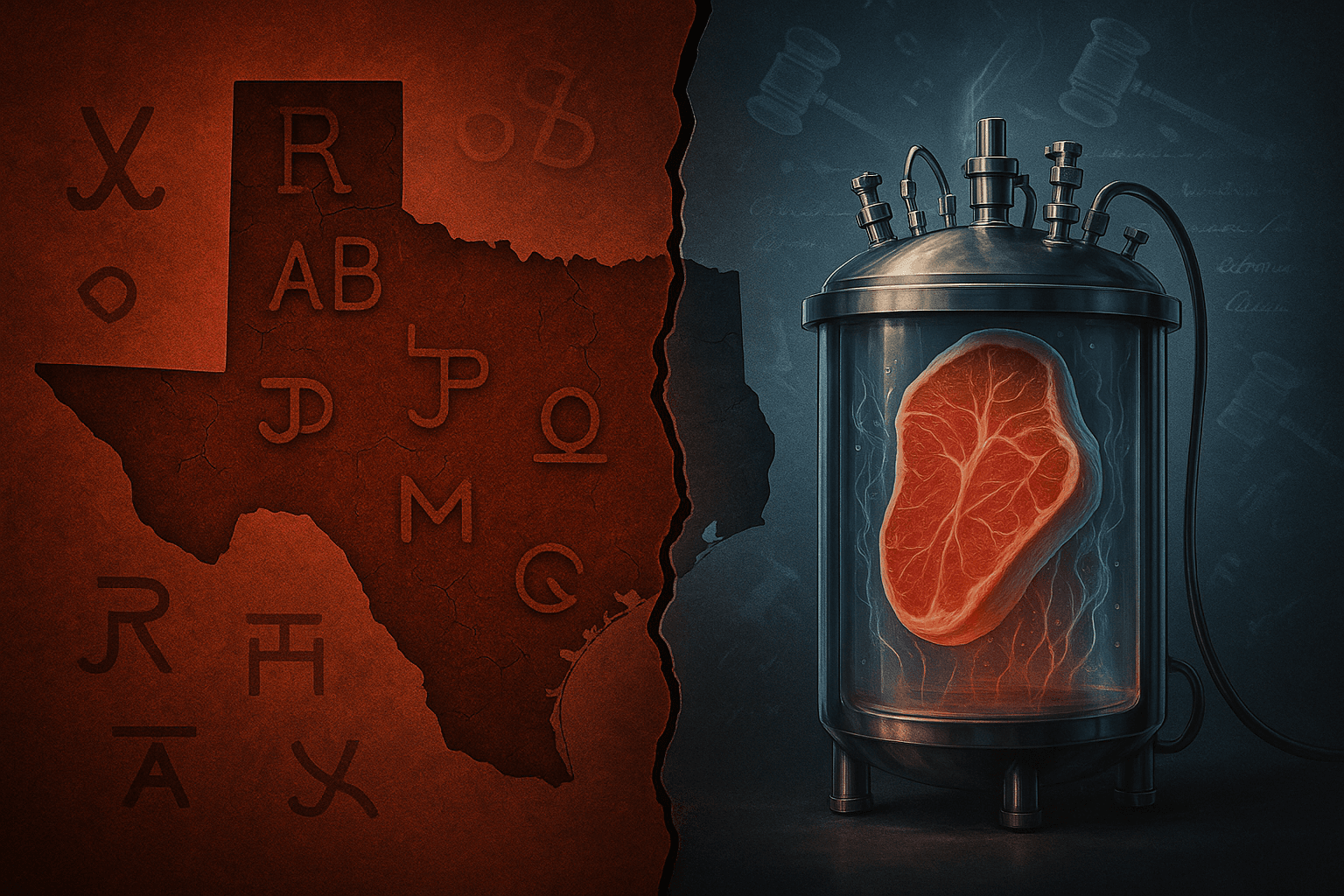

For a decade, CAR-T has been a poster child for modern medicine: take a patient’s immune cells, re-engineer them to recognise a target (often CD19 on B cells), and send them back in to hunt. In certain blood cancers, it can produce deep remissions. Yet the same reasons it can be transformative — personalised cells, tight handling, intense monitoring — also make it expensive, slow, and geographically limited.

Lilly’s logic is simple: if CAR-T could be turned from a bespoke procedure into something closer to a repeatable drug product, its reach could expand dramatically, especially into autoimmune diseases where the patient numbers are far larger than the niche populations of refractory blood cancers. The question is whether biology will cooperate.

Table of Contents

ToggleWhy “in vivo” is the prize

Traditional CAR-T is “ex vivo”: cells are collected from the patient, genetically modified, expanded, quality-tested, shipped back, and infused. That chain is long and fragile. Reviews of current manufacturing describe a typical process that takes 3–6 weeks, with “vein-to-vein” times that can be long enough for some patients to deteriorate before they ever receive the infusion.

The delivery system around these therapies reflects the risk and complexity. US regulators have required special safeguards because of potentially severe toxicities such as cytokine release syndrome (CRS) and neurological effects; hospitals must meet certification requirements and have immediate access to tocilizumab before infusion.

None of this is an argument against CAR-T’s scientific value. It is an explanation for why access is limited — and why the business opportunity, if access improves, is so large.

That is where “in vivo” comes in. Instead of extracting T cells and modifying them in a facility, the in vivo idea is to deliver genetic instructions into the body, so the patient’s own immune cells temporarily produce the CAR and do the job where they already live.

Orna’s approach combines engineered circular RNA with lipid nanoparticles (LNPs). In Lilly’s telling, the platform is designed to let the body “generate” the cell therapy internally — a way to sidestep the ex vivo bottleneck.

Orna’s lead bet: an immune “reset” for autoimmune disease

Orna’s lead programme, ORN-252, is described as a CD19-targeting in vivo CAR-T that is “clinical trial-ready” and aimed at B cell-driven autoimmune diseases.

The autoimmune framing matters. In cancer, persistence of CAR-T cells can be the goal — the longer the engineered cells survive, the longer they can patrol for relapse. In autoimmune disease, the emerging hypothesis is subtly different: you may not need long-lived CAR-T if you can achieve a deep enough “clean-out” of pathological B cells to allow the immune system to rebuild with a more naïve, less autoreactive B-cell pool.

That “immune reset” narrative is no longer just marketing language. In a widely cited 2022 compassionate-use report in severe systemic lupus erythematosus (SLE), five patients received autologous anti-CD19 CAR-T after lymphodepleting chemotherapy; all entered remission by three months, and drug-free remission persisted through follow-up even after B cells returned — with the returning cells skewing naïve.

This is precisely the kind of result that makes large pharma pay attention: a one-time intervention that could replace years of chronic immunosuppression. But it also highlights the constraint: the study used the full ex vivo workflow, including lymphodepletion and specialised handling.

Lilly’s own press materials are explicit about the tension. Early autologous CAR-T studies in autoimmune disease look promising, the company says, but “the complexity, cost, and logistics” of ex vivo approaches make broad delivery difficult.

If Orna can recreate the biological effect without recreating the industrial burden, the addressable market changes.

The science under the hood: targeted nanoparticles and circular RNA

The central technical challenge for in vivo CAR-T is not the CAR. It is delivery: how do you reliably get genetic instructions into the right immune cells, in the right amount, without turning the rest of the body into collateral damage?

A key academic proof point arrived recently from researchers describing an in vivo strategy using targeted lipid nanoparticles (tLNPs) that deliver mRNA to specific T-cell subsets. In that work, the tLNPs reprogrammed CD8+ T cells, produced tumour control in humanised mice, and caused B-cell depletion in cynomolgus monkeys, followed by predominantly naïve B-cell reconstitution — again consistent with an “immune reset” concept.

Orna’s proposition is that circular RNA could make the message more useful than standard linear mRNA. Because circular RNAs have no free ends, they can be more resistant to degradation and can support more prolonged protein expression; reviews also highlight the potential for reduced immunogenicity relative to linear RNA in certain designs.

Orna has been arguing for a “transient, re-dosable” form factor — a notable contrast to viral-vector approaches that can drive longer-lived expression but raise a different set of safety questions. An abstract describing Orna’s panCAR platform explicitly frames it as transient, re-dosable, and potentially scalable, while aiming to avoid preconditioning lymphodepletion.

At the 2025 American Society of Hematology meeting, Orna reported preclinical results for ORN-252 including B-cell depletion in models at low doses and signals in a lupus model such as reductions in anti-dsDNA titres, with the company pointing to primate data showing repopulation skewing naïve. Orna also said it anticipated filing its first clinical trial application and entering the clinic in early 2026.

Those are the sorts of data that, in M&A negotiations, can turn “interesting platform” into “strategic urgency”. But they remain preclinical, and the difference between mice, monkeys and humans has buried many promising therapies before.

Why big pharma is paying billions anyway

Even with the uncertainty, Lilly is not alone in paying up for the in vivo idea. In mid-2025, AbbVie agreed to buy Capstan Therapeutics — another in vivo CAR-T developer — in a deal worth up to $2.1bn.

Taken together, the transactions suggest a shared belief: the next wave of cell therapy will be less about inventing new receptors and more about industrialising delivery — making a powerful, personalised modality behave like a product a global company can manufacture, ship, and administer at scale.

That belief is also consistent with the direction of regulatory housekeeping. The FDA has maintained detailed safety frameworks for CAR-T because of severe adverse events, yet it has also moved to reduce compliance burden where it believes labelling and routine monitoring can do more of the work.

If the endgame is wider use, especially outside tertiary cancer centres, the therapy needs not only efficacy but also a delivery and monitoring model that can work in more ordinary clinical settings.

The hard part: control, safety, and “what happens if it goes wrong?”

The promise of in vivo CAR-T is speed and scale. The risk is that you lose some control.

With ex vivo CAR-T, clinicians know the product has passed release testing and that the patient receives a defined dose of engineered cells. With an in vivo approach, the “dose” becomes more complicated: it is the amount of RNA delivered, the fraction of target immune cells transfected, the duration of expression, and the behaviour of the newly armed cells once they start killing.

The field also has to deal with an awkward truth: toxicities that are manageable in specialised settings become much more serious when a therapy is pushed earlier in disease, or into broader populations. CRS and neurological toxicities are not theoretical; they are prominent enough to have shaped the entire delivery infrastructure for approved CAR-T products.

There is also a strategic question about how durable the effect should be. In autoimmune disease, some of the most intriguing reports show that CAR-T cells may not persist long-term, yet deep B-cell depletion can still be followed by prolonged remission — again raising the possibility that a “hit hard, then exit” profile may be desirable.

Orna’s “transient, re-dosable” framing implicitly leans into that: it suggests a way to treat the immune system like a system you can reset — and, if needed, reset again — rather than a permanently rewritten machine.

Yet re-dosing is not a free lunch. Repeat exposure to LNPs and RNA can raise its own immune and tolerability questions, and regulators will expect clear answers about on-target and off-target effects in humans.

What to watch next

Lilly’s acquisition price looks large for a company that, by its own descriptions, is at the edge of first-in-human work. But the structure gives a hint of how pharma is thinking: shareholders “could receive up to” $2.4bn, with part of the payout tied to clinical development milestones.

The next milestones are not commercial. They are scientific:

- Can Orna consistently programme the intended immune cells in humans? (Delivery is everything.)

- Can it avoid the worst toxicities while still achieving deep depletion of disease-driving B cells? (Efficacy and safety move together here.)

- Can it show a credible “immune reset” signal — durable clinical benefit after B-cell return — without requiring heavy preconditioning? (This is the autoimmune prize.)

- Can it do all of that with a manufacturing model that truly scales? (A platform that only a few centres can administer is not a platform.)

If the answers are positive, in vivo CAR-T could do something rare in biotech: it could expand a powerful therapy not just into new indications, but into a new shape — from custom-built intervention to distributable medicine.

If the answers are negative, Lilly’s deal will still be instructive. It would confirm a pattern seen repeatedly in biotech: the gap between “possible in principle” and “reliable in patients” is where most value is created — and where most risk lives.

Either way, the acquisition is a clear signal that the industry’s next ambition is not simply to engineer better cells. It is to engineer better access.