Table of Contents

Toggle1. Introduction

Background on Illumina and Grail

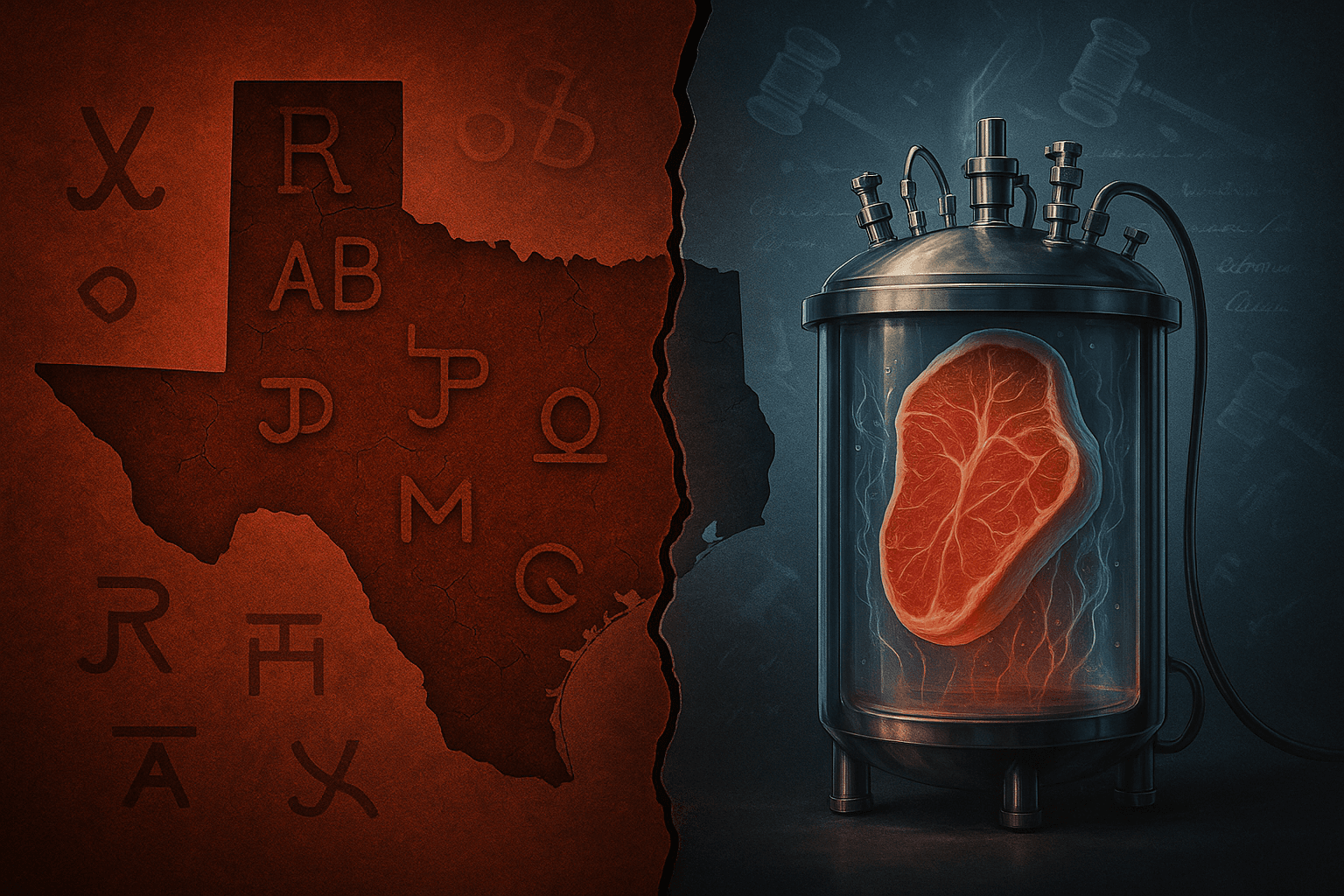

Illumina, Inc. is a prominent player in the biotechnology industry, known for its innovations in genomic sequencing. Founded in 1998 and headquartered in San Diego, California, Illumina’s technology has been pivotal in advancing research across various fields, including cancer genomics, reproductive health, and agriculture.

Grail, Inc., a company dedicated to early cancer detection, was originally founded as a subsidiary of Illumina in 2016. Grail’s flagship product, the Galleri test, is a multi-cancer early detection (MCED) test that uses blood samples to detect more than 50 types of cancer before symptoms appear. This innovative approach aims to improve cancer survival rates by diagnosing the disease at its earliest stages.

Purpose of the Report

This report aims to analyze the implications of Illumina’s forced divestiture of Grail, focusing on the financial, regulatory, and industry-wide impacts. It will delve into the details of the acquisition, the regulatory challenges that led to the forced sale, and the potential consequences for both companies and the biotech sector at large.

2. Details of the Acquisition

Acquisition Overview

Illumina’s acquisition of Grail was finalized on August 18, 2021. The deal was valued at approximately $7.1 billion, consisting of $3.5 billion in cash and the issuance of Illumina common stock to Grail stockholders. Additionally, Grail stockholders were entitled to contingent value rights (CVRs) that could potentially yield future payments based on Grail’s revenue performance over a 12-year period. This structure was designed to align the financial interests of Grail’s stakeholders with the future success of its cancer detection technologies.

The acquisition was driven by Illumina’s strategic objective to integrate Grail’s MCED technology with its own genomic sequencing capabilities. Illumina believed that by bringing Grail back under its umbrella, it could accelerate the commercialization of the Galleri test, making it more accessible and affordable. This, in turn, was expected to significantly impact public health by enabling earlier cancer detection and intervention.

Strategic Objectives

Illumina had several key strategic objectives for acquiring Grail:

- Accelerate Innovation: By leveraging Illumina’s sequencing technology, Grail’s MCED test could be further developed and enhanced, potentially leading to breakthroughs in cancer diagnostics.

- Expand Market Reach: Illumina aimed to use its global reach to expedite the distribution of the Galleri test, particularly in markets where early cancer detection is critical.

- Enhance Competitive Position: The acquisition was seen as a way to solidify Illumina’s leadership in the genomic sequencing market by incorporating a groundbreaking diagnostic tool that complements its existing product portfolio.

- Improve Public Health Outcomes: Ultimately, the integration was expected to save lives by providing widespread access to early cancer detection, thereby improving treatment outcomes and reducing healthcare costs.

Despite these strategic objectives, the acquisition faced significant regulatory hurdles, particularly from the European Commission and the Federal Trade Commission (FTC), which argued that the merger could hinder competition and innovation in the cancer diagnostics market.

3. Regulatory Challenges

Antitrust Concerns

The acquisition of Grail by Illumina faced significant regulatory hurdles from both the European Commission (EC) and the Federal Trade Commission (FTC) in the United States. The primary concern from these regulatory bodies was the potential for Illumina to stifle competition in the emerging market for multi-cancer early detection (MCED) tests.

The European Commission argued that Illumina, by acquiring Grail, would have the ability and incentive to foreclose competition. This could be done by restricting Grail’s competitors’ access to Illumina’s next-generation sequencing (NGS) technology, which is critical for developing and running early cancer detection tests. The Commission emphasized that there are no credible alternatives to Illumina’s NGS systems in the short to medium term, making it difficult for competitors to switch suppliers without incurring significant costs and delays.

In response to these concerns, Illumina proposed several remedies, including licensing some of its NGS patents and committing to non-discriminatory agreements with Grail’s competitors. However, the European Commission rejected these proposals, finding them insufficient to prevent the risk of foreclosure and the potential negative impact on innovation

Legal Proceedings

The regulatory scrutiny led to a series of legal battles. In September 2022, an Administrative Law Judge (ALJ) in the U.S. ruled in favor of Illumina, dismissing the FTC’s challenge. The ALJ concluded that the acquisition would not harm competition and could potentially benefit consumers by accelerating innovation and reducing healthcare costs.

However, shortly after this decision, the European Commission issued a prohibition order, requiring Illumina to divest Grail. Illumina appealed this decision, but the European General Court upheld the Commission’s jurisdiction to review and block the acquisition.

In December 2023, facing continued regulatory pressure and legal challenges, Illumina announced its decision to divest Grail. The company indicated that it would comply with the European Commission’s divestiture order, aiming to finalize the terms by mid-2024.

4. Financial Implications

Potential Financial Loss

The forced divestiture of Grail could result in a substantial financial loss for Illumina, estimated at around $7 billion. This figure includes the initial cost of the acquisition as well as potential penalties and the costs associated with unwinding the merger. Illumina had set aside approximately $453 million to cover a potential fine for closing the acquisition before obtaining the necessary regulatory approvals, a practice known as “gun-jumping”.

The financial implications extend beyond the immediate loss. The uncertainty and legal battles have also impacted Illumina’s stock performance and market valuation. Since the acquisition, Illumina’s stock has experienced significant volatility, reflecting investor concerns over the regulatory risks and potential financial penalties.

Market Reactions

The market reactions to the regulatory challenges and the subsequent decision to divest Grail have been mixed. While some investors appreciate Illumina’s commitment to resolving the regulatory issues and minimizing further financial losses, others are concerned about the long-term impact on Illumina’s strategic goals and market position.

Overall, the regulatory challenges and financial implications of the Grail acquisition highlight the complexities and risks associated with large biotech mergers, particularly in highly innovative and competitive fields like cancer diagnostics. The case underscores the importance of navigating regulatory landscapes carefully and the potential consequences of failing to do so.

5. Impact on Innovation and Competition

Implications for Cancer Detection Technology

The forced sale of Grail by Illumina is expected to have significant implications for the innovation and competition within the cancer detection technology sector. Grail, with its flagship Galleri test, has been at the forefront of developing multi-cancer early detection (MCED) tests that can identify more than 50 types of cancer from a single blood sample. The European Commission and the U.S. Federal Trade Commission (FTC) raised concerns that Illumina’s acquisition of Grail would stifle competition by potentially limiting other companies’ access to essential next-generation sequencing (NGS) technology, which is critical for developing similar early detection tests.

The European Commission argued that Illumina would have the ability and incentive to foreclose Grail’s competitors, effectively stifling innovation in this nascent and highly competitive market. Without access to Illumina’s NGS systems, rivals would face significant barriers, potentially slowing down the development and commercialization of new cancer detection technologies.

The regulatory bodies emphasized that maintaining competition is crucial for the continued innovation and improvement of early cancer detection methods. By ensuring Grail operates independently, the European Commission aims to foster a competitive environment where multiple players can innovate and improve upon existing technologies, ultimately benefiting patients with more options and better diagnostic tools.

Industry and Market Dynamics

The decision to force Illumina to divest Grail has broader implications for the biotech industry, particularly regarding how mergers and acquisitions are viewed and regulated. The case sets a precedent for how regulatory bodies might handle similar transactions in the future, emphasizing the importance of preserving competition even in highly specialized and emerging markets.

This regulatory scrutiny serves as a reminder to biotech companies about the potential challenges and risks associated with mergers and acquisitions, especially when these involve critical technologies with limited alternative suppliers. Companies in the biotech sector must now carefully consider the potential regulatory implications of their strategic decisions, ensuring they do not inadvertently hinder competition and innovation.

The impact on market dynamics can also be seen in the financial and strategic adjustments companies may need to make in response to regulatory actions. Illumina’s decision to comply with the divestiture order and its plans to spin off Grail as an independent entity reflect a shift in how companies might approach growth and expansion in the future. This case underscores the need for a balanced approach that supports both business growth and the competitive landscape of the industry.

6. Responses and Statements

Illumina’s Position

Illumina has consistently argued that its acquisition of Grail is in the best interest of patients and is pro-competitive. The company emphasizes that reuniting with Grail would allow it to leverage its global scale, manufacturing capabilities, and regulatory expertise to bring Grail’s breakthrough multi-cancer early detection test to market more quickly and affordably. Illumina believes that the Galleri test, which can detect over 50 types of cancer from a single blood sample, has the potential to save many lives by enabling earlier cancer detection and treatment.

Illumina has also expressed disagreement with the regulatory actions taken by both the European Commission and the Federal Trade Commission (FTC). The company contends that the European Commission does not have jurisdiction over the acquisition as both companies are based in the United States. Illumina has appealed the divestiture orders and continues to seek a resolution that would allow it to retain Grail.

Despite the regulatory challenges, Illumina has announced plans to comply with the divestiture order and is preparing to spin off Grail as an independent entity. The company will maintain a minority stake in Grail and believes this move will still allow it to contribute to the advancement of cancer detection technologies.

Regulatory Perspectives

The European Commission and the FTC have both taken a strong stance against the Illumina-Grail merger, citing significant concerns about its potential impact on competition and innovation in the cancer diagnostics market. The European Commission argues that the merger would give Illumina the ability and incentive to foreclose Grail’s competitors by restricting their access to essential NGS technology, which is critical for developing early cancer detection tests.

The FTC has also raised concerns that the acquisition would substantially reduce competition in the U.S. market for the research, development, and commercialization of cancer tests. The FTC believes that maintaining Grail’s independence is crucial for preserving competition and ensuring that the market remains dynamic and innovative.

Regulatory bodies emphasize that their actions are aimed at protecting competition and fostering an environment where multiple companies can innovate and improve cancer detection technologies, ultimately benefiting consumers with more options and better diagnostic tools.

7. Conclusion

Summary of Key Points

The Illumina-Grail acquisition has faced significant regulatory challenges from both the European Commission and the FTC, leading to a forced divestiture. Despite Illumina’s arguments that the merger would accelerate innovation and improve patient outcomes, regulators are concerned about the potential anti-competitive effects and the impact on innovation in the cancer diagnostics market.

Future Outlook

The divestiture of Grail is set to proceed, with Illumina preparing to spin off the company while maintaining a minority stake. This decision underscores the importance of regulatory compliance and the need for a balanced approach that supports both business growth and competitive market dynamics.

Final Thoughts

The case highlights the complex interplay between business strategy, regulatory oversight, and market dynamics in the biotech sector. Ensuring a competitive environment is crucial for fostering innovation and improving public health outcomes, particularly in fields as critical as cancer detection.

By maintaining a focus on innovation and compliance, companies can navigate these challenges and continue to contribute to advancements in healthcare technology.