On December 22, 2025, the U.S. Food and Drug Administration approved Wegovy as a once-daily pill — the first oral GLP-1 cleared for chronic weight management in adults with obesity (or overweight with at least one weight-related condition). Novo Nordisk is also putting a second flag on the label: the pill version is indicated to reduce the risk of major adverse cardiovascular events in adults with overweight or obesity who already have cardiovascular disease.

That sounds like a simple format change — from needle to tablet. In practice, it changes at least four things at once: who shows up to treatment, how supply moves through the system, how payers decide what “medical necessity” means, and how long the current leaders can stay ahead in an increasingly crowded race.

If injectable GLP-1s turned obesity into one of the biggest commercial stories in modern medicine, the pill form raises a more uncomfortable question: what happens when “powerful enough to matter” also becomes “easy enough to scale”?

Table of Contents

ToggleWhat the FDA actually approved (and what patients will actually take)

Start with the fine print, because it’s where adoption succeeds or fails.

The newly approved regimen is oral semaglutide under the Wegovy brand, with a 25 mg daily maintenance dose — but most patients won’t begin at 25 mg. Novo’s prescribing information lays out a step-up schedule designed to reduce gastrointestinal side effects: 1.5 mg daily for 30 days, then 4 mg (days 31–60), 9 mg (days 61–90), and 25 mg from day 91 onward.

Then there is the “tablet tax”: how you have to take it. The label instructs patients to take the pill on an empty stomach in the morning, with water only (up to 4 ounces), and to wait at least 30 minutes before eating, drinking anything else, or taking other oral medicines.

This matters because the commercial pitch for a pill is “convenience.” The lived reality is “a new morning routine.” For some people that will be easier than injections. For others — especially patients already juggling multiple morning medications — it may be its own kind of friction.

Still, the regulatory message is clear: the FDA is comfortable treating the oral version as a full member of the Wegovy franchise, including cardiovascular risk reduction in the right population.

The data: how much weight loss, and how close to the injection?

The approval rests on OASIS 4, a 64-week phase 3 trial in 307 adults with obesity or overweight plus comorbidities, without diabetes, according to Novo’s U.S. announcement and its detailed release.

The headline number Novo is emphasizing is the “if everyone stayed on treatment” estimate: 16.6% mean weight loss versus 2.7% with placebo.

Using the trial’s baseline weight (about 235 pounds), that is roughly 39 pounds lost on treatment versus about 6 pounds on placebo.

But regulators and clinicians also care about the messier real-world view: the “regardless of discontinuation” analysis. There, Novo reports about 13.6% mean weight loss versus 2.4% with placebo — closer to 32 pounds versus about 6 pounds, again using the trial’s baseline.

Two more details signal why Novo is upbeat:

- About one in three participants hit ≥20% weight loss, a threshold that starts to feel less like “diet success” and more like “a new metabolic set point.”

- Novo argues the pill’s weight loss is similar to injectable Wegovy (2.4 mg weekly) — important because it neutralizes the common assumption that pills are always the weaker form.

Put differently: this is not a “nice alternative.” It is being positioned as a comparable engine in a friendlier wrapper.

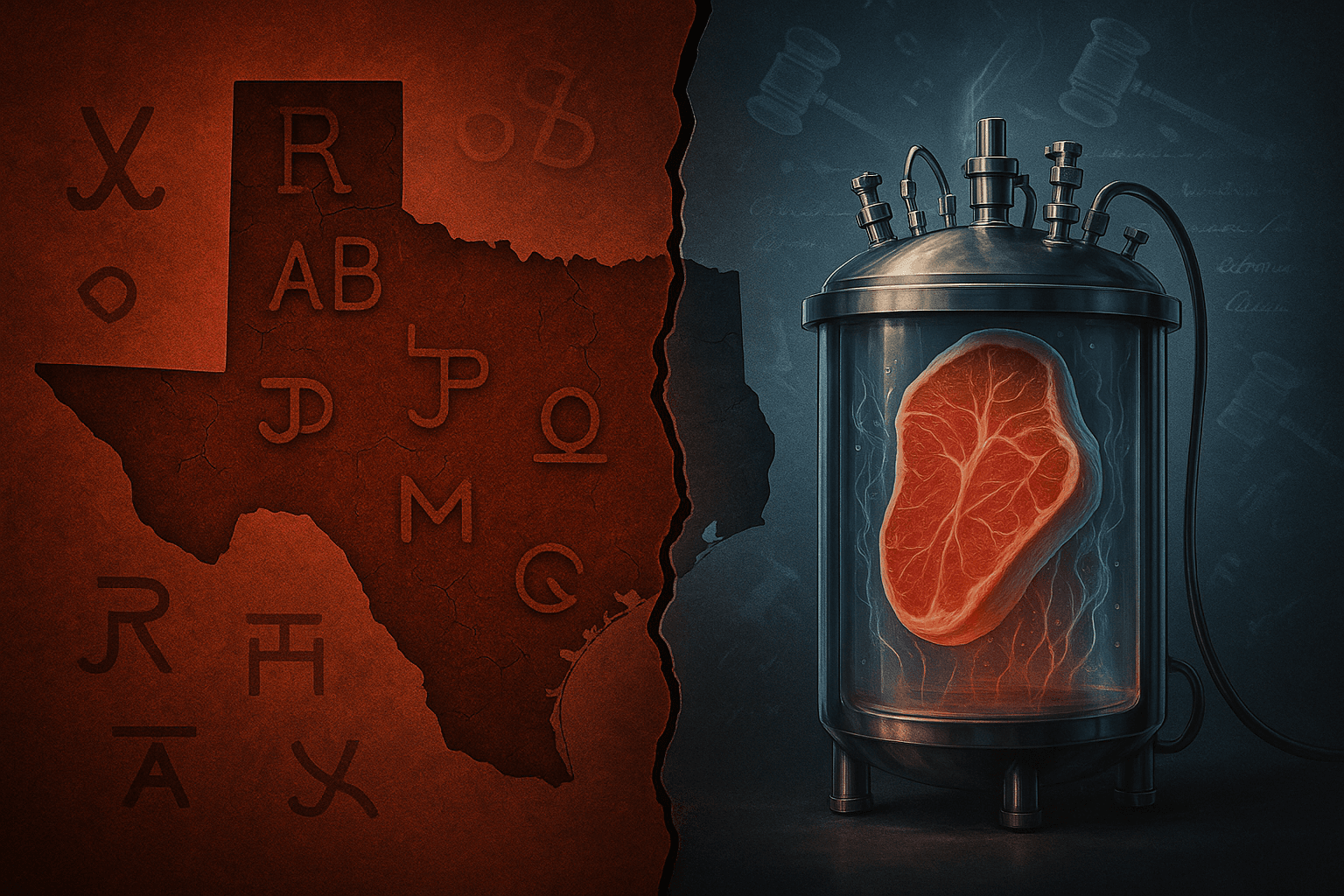

Why a pill changes the market — even if the molecule is familiar

Semaglutide is not new. The market shock is distribution.

A weekly injection is a controlled, medical-adjacent product: starter visits, training, cold-chain habits, and a subtle sense of “this is serious medicine.” A daily pill is psychologically closer to blood pressure drugs — routine, repeatable, and easier to imagine starting earlier.

That has three second-order effects:

- More first-time patients. Some people refuse injections on principle. Reuters flagged “injection hesitancy” and “no refrigeration” as part of the appeal.

- More prescribing settings. A pill can move faster into primary care workflows (and into telehealth), even if the rules for taking it are strict. Novo’s U.S. release signals distribution through pharmacies and “select telehealth providers” as early as January 2026.

- A different supply bottleneck. Injectable GLP-1s are not constrained only by API; they’re constrained by devices, fill-finish, packaging, and cold-chain logistics. Tablets don’t eliminate manufacturing difficulty — they change where it shows up. Novo says it is preparing U.S. supply through North Carolina operations.

The quiet implication is that the next phase of the GLP-1 boom may be less about convincing doctors and more about feeding demand without collapsing the system.

The price story: a cheaper “entry” is not the same as broad access

Novo’s announcement and news coverage highlight a number designed to travel well on social media: $149 per month. But it comes with asterisks. Novo describes $149/month as a savings offer tied to an early-January availability for the starting dose (1.5 mg), with fuller coverage and savings details to follow.

Separately, Reuters reported Novo has lowered the cash price of injectable Wegovy to $349 per month (again, not the list price), and has been striking pricing arrangements with various programs and platforms.

So the real access question isn’t “needle or pill?” It’s still “who pays, and for whom?”

In the U.S., obesity treatment sits inside a policy contradiction:

- The CDC reports obesity prevalence at 40.3% among U.S. adults in the Aug 2021–Aug 2023 window — a scale problem, not a niche one.

- Yet Medicare’s outpatient drug benefit has a long-standing restriction: under current law, anti-obesity drugs are generally not covered for obesity itself, though they may be covered for other FDA-approved indications (such as diabetes or cardiovascular risk reduction) depending on the product and circumstances.

- KFF notes that state Medicaid coverage for obesity treatment with these drugs is limited (their 2024 analysis cited 13 states covering them for obesity treatment at that time).

A pill does not resolve these constraints. It can, however, increase pressure on them — because once a therapy feels easy, the moral argument for excluding it becomes harder to defend.

Competition: Novo gets first-mover advantage — but the pill race is just starting

Novo’s approval lands as Eli Lilly is building momentum with Zepbound (injectable tirzepatide) and pushing its own oral candidates. News coverage of the approval explicitly frames the pill as a competitive edge while Lilly’s oral GLP-1, orforglipron, remains under FDA review.

Orforglipron has produced meaningful weight-loss signals in clinical studies — for example, a prominent phase 2 study reported weight reduction ranges up to ~14.7% at 36 weeks depending on dose.

But “later with a different molecule” is not the same as “now with a proven brand.” First approval matters in two ways that don’t show up in trial charts:

- It shapes habit formation (what clinicians reach for first).

- It shapes formularies (what insurers decide is the default).

That matters because the obesity market is expected to be enormous. Forecasts vary, but even cautious projections still imply a category that could reach on the order of ~$95 billion globally by 2030, per Goldman Sachs Research.

Novo’s opportunity is to make Wegovy the “metformin” of obesity care — the first-line default. Its risk is that, once pills become normal, payers may treat them like commodities and squeeze pricing harder.

The thought-provoking part: will the pill normalize obesity care — or widen the gap?

The political economy of obesity treatment has always been awkward. The condition is common, but coverage is narrow. The science is strong, but the stigma is stubborn. The costs are immediate, while the savings (fewer heart attacks, fewer strokes, fewer dialysis starts) show up over years.

Wegovy’s cardiovascular outcomes data has already strengthened the “this is not cosmetic” argument. In March 2024, the FDA expanded Wegovy’s label for cardiovascular risk reduction based on outcomes data showing fewer major events in the semaglutide arm than placebo.

Now the pill carries a similar intent: obesity treatment as a path to reducing hard endpoints, not just improving how clothes fit.

But here’s the tension. If daily pills expand demand faster than coverage expands, the market could drift toward a two-tier system:

- one tier for patients with generous employer coverage or the ability to self-pay;

- another for everyone else, stuck in lifestyle counseling and late-stage interventions.

In that world, the pill doesn’t simply “democratize access.” It makes inequality more visible — because the therapy is close enough to routine to feel like it should be available, yet expensive enough to remain gated.

What to watch next

In early 2026, the story will move from approval to behavior. Three indicators will matter more than headlines:

- Adherence in the real world. The trial shows two numbers — ~16.6% “if all stayed on treatment” and ~13.6% “regardless.” The gap between those two is where payer skeptics live.

- Supply stability. If tablets reduce friction and demand rises, can manufacturing keep up without pushing patients back into gray markets?

- Coverage creep. If a pill makes obesity care feel like standard chronic care, insurers may face sharper pressure to cover it — or to cover it with stricter rules. Medicare policy debates won’t stay theoretical for long.

For now, Novo has done something rare in biotech: it has made an already transformative therapy easier to live with, without clearly giving up efficacy. The needle made obesity drugs powerful. The pill makes them scalable.

And scaling, in healthcare, is where science stops being merely impressive — and starts forcing society to decide what it actually values.