With a $130m Series B, the startup is betting that “computer-aided design” can move biologics beyond trial-and-error — and into something closer to software.

In biotech, there is a familiar rhythm to a new “breakthrough”. A flashy chart. A promising molecule. A sentence that begins, “for the first time”. Then come the years: animal studies, manufacturing headaches, clinical trials, regulators, and the uncomfortable truth that biology does not always care about elegance.

Chai Discovery is trying to change that rhythm — not by making better slides, but by trying to make the messy middle of drug discovery behave more like engineering.

On December 15, 2025, Chai announced a $130 million Series B at a $1.3 billion valuation, co-led by Oak HC/FT and General Catalyst, with participation from Thrive Capital, OpenAI, Dimension, Menlo Ventures and others; new investors include Emerson Collective and Glade Brook. The round takes total funding to more than $225 million, and adds Annie Lamont (Oak HC/FT) and Hemant Taneja (General Catalyst) to the board.

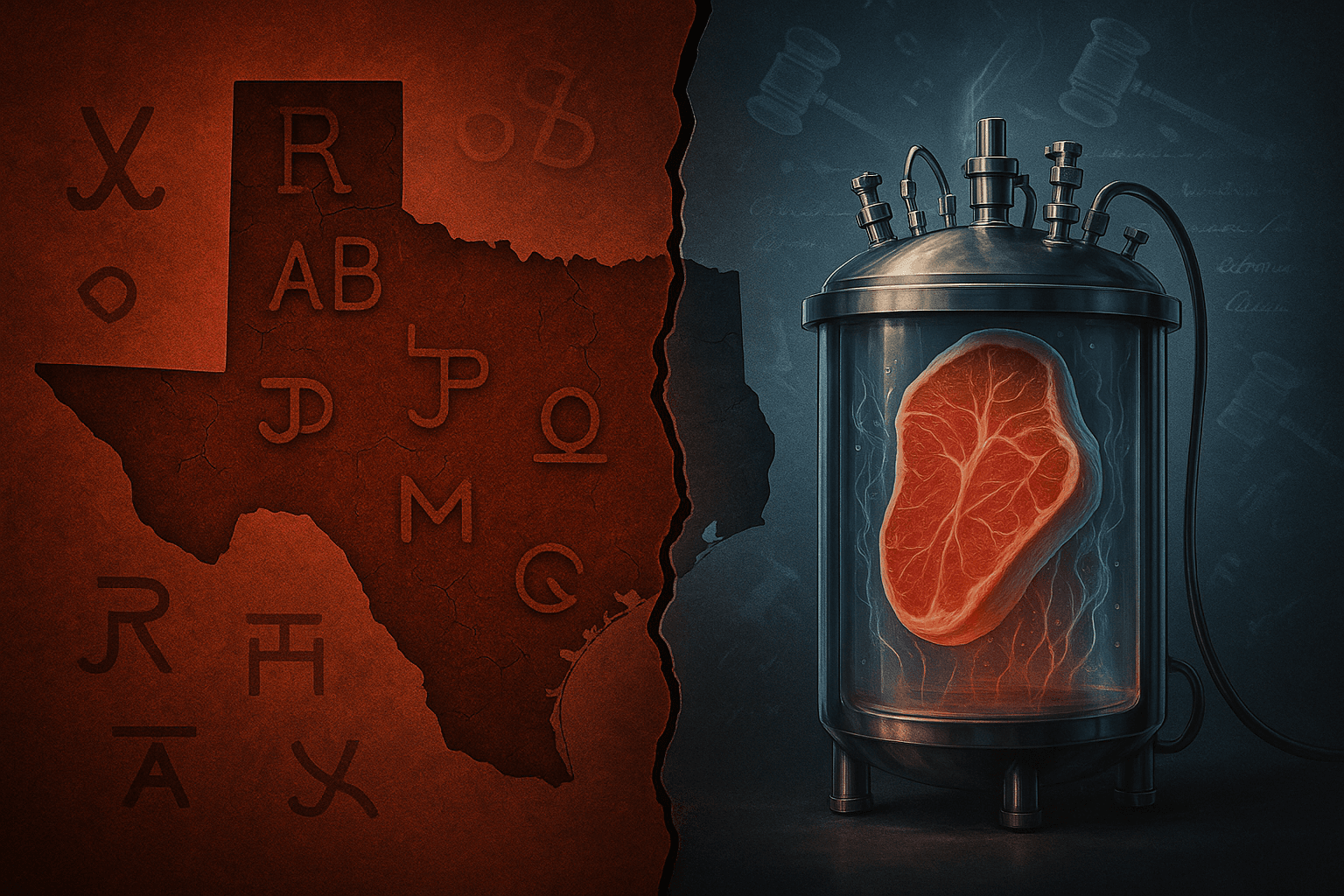

That is the fundraising headline. The bigger story is what Chai is selling: the idea that designing a biologic drug — especially an antibody — can become something closer to “computer-aided design”, where the computer proposes candidates that look and behave like real medicines, not just lab curiosities.

It is a bold promise in a business defined by time, probability, and expensive disappointment.

Table of Contents

ToggleWhy “CAD for molecules” is suddenly a sensible sentence

The easiest way to understand Chai’s timing is to look at what just happened in science. In 2024, the Nobel Prize in Chemistry went to work on protein design and protein structure prediction, reflecting how quickly AI has changed what biologists can do with proteins — the key machinery of life.

AlphaFold-era models helped the world “see” proteins more clearly — to predict shapes that used to require painstaking experiments. But seeing is not the same as building. And in drug discovery, “building” means more than making something that binds.

A therapeutic molecule has to survive the real world: it must be manufacturable at scale, stable on a shelf, predictable in the body, safe enough to dose, and consistent enough that regulators trust the process. Chai’s bet is that AI can do more than predict structure. It can propose drug-like designs — the kind that can plausibly graduate from early research to a development program.

The claim matters because the industry’s baseline is brutal. Industry groups often cite 10–15 years to develop a medicine, and cost estimates range widely; peer-reviewed work in JAMA Network Open describes R&D cost estimates spanning roughly hundreds of millions to several billions of dollars, depending on methods and therapeutic area.

Even after all that, only a minority of clinical programs make it to market — McKinsey, for example, has cited about 13% of assets entering Phase 1 eventually launching.

So when a startup says it can “compress” timelines, investors hear a familiar siren song. The question is whether the math is finally starting to work.

What Chai says it can do

Chai is not the first company to use AI in drug discovery. What differentiates the new wave — the one being funded at billion-dollar valuations — is the claim that the models can generate not just candidates, but useful candidates.

Chai’s narrative begins with models. After a seed round (and then a $70 million Series A in August 2025), the company positioned itself as a builder of foundation models for molecular work — and as a company willing to release some things openly. The Series A announcement described Chai-1 as an open-source foundation model for molecular structure prediction.

Then came Chai-2, which Chai markets as a jump from “prediction” to “design”.

In June 2025, Chai said Chai-2 achieved a near-20% antibody design hit rate — far above the below-0.1% hit rates it attributed to prior computational approaches — and reported “hits” across roughly 50 antibody targets, often testing fewer than 20 designs per target, with lab validation in under two weeks.

In one anecdote, the company said a challenge that had absorbed more than $5 million in traditional R&D spend was solved “in just a few hours” and validated in the lab within two weeks.

As stories go, it’s a good one. But Chai’s more interesting move was to shift the discussion from binding — the usual headline metric — to “developability”, the set of properties that often quietly kill drug candidates.

In a November 2025 technical update, Chai said it tested 88 Chai-2-designed full-length antibodies (IgGs) across 28 antigens on developability criteria, and that 86% of designs showed zero or one flagged issue, meeting the company’s stated bar for preclinical candidate selection; 24 of 28 antigens yielded at least one design with a clean developability profile.

Chai also says cryo-EM validation of five designed antibody–antigen complexes showed binding where intended, with “sub-angstrom” accuracy even in difficult regions, which it presents as evidence that the model can reason about atomic detail rather than producing vague, approximate solutions.

For a reader outside biotech, this may sound like hair-splitting. It isn’t.

Why antibodies are the right battlefield

Antibodies are not a niche technology. They are one of the most commercially important drug classes of the last few decades — and they are still gaining share.

A 2025 analysis of FDA approvals reported that in 2024, the FDA authorized 50 new drugs and that 13 monoclonal antibodies were approved — described as a record — with mAbs accounting for more than a quarter of the year’s approvals in that dataset.

Antibodies are attractive because they can be exquisitely specific. They can also be maddeningly hard to perfect. A typical antibody discovery process might begin with huge libraries and lots of screening. You might find a binder, then spend months to years optimizing it to behave well as a medicine.

This is where Chai’s “CAD” analogy becomes more than marketing. In mechanical engineering, CAD didn’t eliminate wind tunnels or crash tests — but it shifted work upstream, making iteration cheaper and faster. Chai is implying something similar: fewer brute-force screens; more purposeful design; faster loops.

The November post makes another point: many antibody design efforts focus on simplified formats (fragments, single domains), while therapeutics are often full monoclonal antibodies. Chai says it can design full-length mAbs while maintaining high hit rates — a claim meant to move the conversation from “interesting binders” to “something closer to a real drug starting point.”

The “hard targets” pitch — and why it sells

Biotech investors have a soft spot for the phrase “undruggable”. Not because they like impossible problems, but because drugging the undruggable is where pricing power, differentiation, and new markets live.

Chai leans into this idea. The Series B press release explicitly says the company’s latest models can tackle “hard-to-drug” targets and that AI can “materially compress” time to first-in-human studies.

Its November post adds details: it applied Chai-2 to six GPCRs and a peptide–MHC target, reporting binders with relatively small numbers of designs tested per target and noting agonists for some GPCRs.

This matters because GPCRs are among the most important target families in pharmacology — and they’re also a reminder of how uneven “druggability” can be across modalities.

A 2025 Nature Reviews Drug Discovery review found 516 approved drugs targeting GPCRs, making up 36% of all approved drugs — enormous.

But those drugs have historically been dominated by small molecules, not antibodies. If Chai can make antibodies against certain difficult membrane targets more practical, it could expand what “biologic-first” discovery looks like.

Notice the conditional verbs. This is still early science, not an approved medicine.

Why investors are pouring money into this category anyway

Chai’s funding round sits inside a broader re-rating of “AI-native” biotech.

PitchBook reported in late November that over the last 12 months, VCs invested about $3.2 billion across 135 deals in AI-driven drug development, and argued that AI-native biotechs have valuation premiums relative to peers.

There is also a corporate signal: big pharma is not just buying AI; it’s building infrastructure for it. In October, Eli Lilly said it would collaborate with Nvidia on an AI supercomputer intended to train models on millions of experiments, with some models available through its TuneLab platform. This is part of a wider industry push to use AI for faster, cheaper R&D.

That matters for Chai because “CAD for molecules” only becomes real when it is integrated into day-to-day workflows — not treated as a side project.

The catch: biology is not software, and the clinic keeps score

Here is the uncomfortable part of the story — and it is also why Chai is interesting.

Drug discovery has had “AI moments” before. Every decade brings a new set of tools that promise to reduce failure: high-throughput screening, combinatorial chemistry, genomics, rational design, big data. They all helped. None eliminated the fundamental risk that the molecule that looks great on paper disappoints in people.

Even now, the “first AI-discovered drug approval” remains a moving target. Recent reporting has noted that no AI-developed drugs have yet been approved for human use, even as AI helps identify candidates and speed up early discovery.

So how should a serious reader interpret Chai’s hit rates and developability claims?

One answer is: these are necessary, not sufficient. A model that can generate binders — even drug-like binders — still has to confront immunogenicity surprises, off-target biology, complex disease biology, and the long grind of clinical outcomes. “Sub-angstrom” structural accuracy is impressive. It is not a surrogate endpoint for survival curves.

Another answer is: the bar for AI in drug discovery is changing. The earliest AI hype was often about replacing scientists. The more plausible future is narrower and more powerful: machines that propose candidates faster, and humans (and labs) that validate and iterate with more discipline.

Chai’s rhetoric reflects that shift. It describes itself as an applied research lab trying to turn biology into an engineering discipline.

That framing is less “AI will cure everything” and more “we can change the unit economics of iteration”.

If that sounds modest, consider what iteration costs today.

A different kind of moat: not just data, but feedback loops

One reason this sector is hard to judge from the outside is that the key assets are not always visible.

A “model” is not the moat. Many models can be copied, matched, or leapfrogged. The moat is often the loop: how quickly a company can go from an in-silico proposal to a wet-lab result, feed that back into the system, and do it again — with reliable measurement, good automation, and tight statistical discipline.

Chai emphasizes speed — “under two weeks” to lab validation in its June release, and rapid progress in its Series B materials.

General Catalyst’s investment note also highlights founder backgrounds in frontier AI and antibody design, and points to a founder group that has worked across OpenAI/Meta-style AI research and biotech applications.

This is where OpenAI’s presence on the cap table becomes more than a branding line. Chai is effectively saying: the same kind of scaling logic that transformed language models can be applied to molecular design — but only if you can anchor it to experimental reality.

That last clause is doing a lot of work.

What Chai will need to prove next

The Series B gives Chai time and resources. It does not give it a shortcut around biology. So the milestones that matter are not just “more models”.

Three proof points will likely define whether Chai becomes a platform company, a drug company, or an acquisition target:

- Adoption inside pharma workflows

Chai says it will expand commercialization and build a “computer-aided design suite” for molecules.

The real question is whether major drug developers trust it enough to put programs on it — and to keep using it after the first excitement. - Repeatability across targets, not hero stories

The most persuasive data in molecular design is boring: the same outcome, again and again, across diverse targets, with clear definitions of “hit” and “success”. Chai’s November update is a step in that direction, because it tries to quantify developability across dozens of designs and targets. - A visible line of sight to the clinic

Investors ultimately want clinical assets — even if the business model begins as software. The fastest way to silence skepticism is not another preprint. It is a program that enters humans and behaves as predicted.

It helps that regulators are also getting more comfortable with AI’s role in drug development, at least as a supporting tool. The FDA has described increased use of AI components in drug submissions, and recently qualified its first AI-based drug development tool for MASH trials — a sign that “AI inside the process” is becoming normal.

That does not mean the FDA will rubber-stamp AI-designed medicines. It does mean the agency is building vocabulary and comfort with AI-driven evidence — an important tailwind for companies that can produce rigorous validation.

The deeper bet: can biotech become an engineering discipline?

Chai’s pitch is seductive because it aims at the industry’s most painful constraint: time.

If you could design candidates that behave like drugs earlier — not just binders, not just structures — you could move failure upstream and reduce wasted years. You could also expand the set of targets worth pursuing, because the cost of “taking a shot” would fall.

But there is a second-order effect that investors sometimes miss. If AI makes it cheaper to generate candidates, the scarce resource shifts. The bottleneck moves to clinical operations, manufacturing capacity, and the ability to run smart trials — the parts of biotech that are still stubbornly physical.

In that world, the winners won’t just have the best models. They’ll have the best integration: models, assays, automation, development judgment, and regulatory strategy stitched together into one coherent machine.

Chai’s Series B is, in a sense, a wager that it can build that machine — and that the biopharma industry is ready to use it.

Whether that wager pays off will not be decided by valuations or press releases. It will be decided, slowly and publicly, in the place biotech always ends up: the clinic.