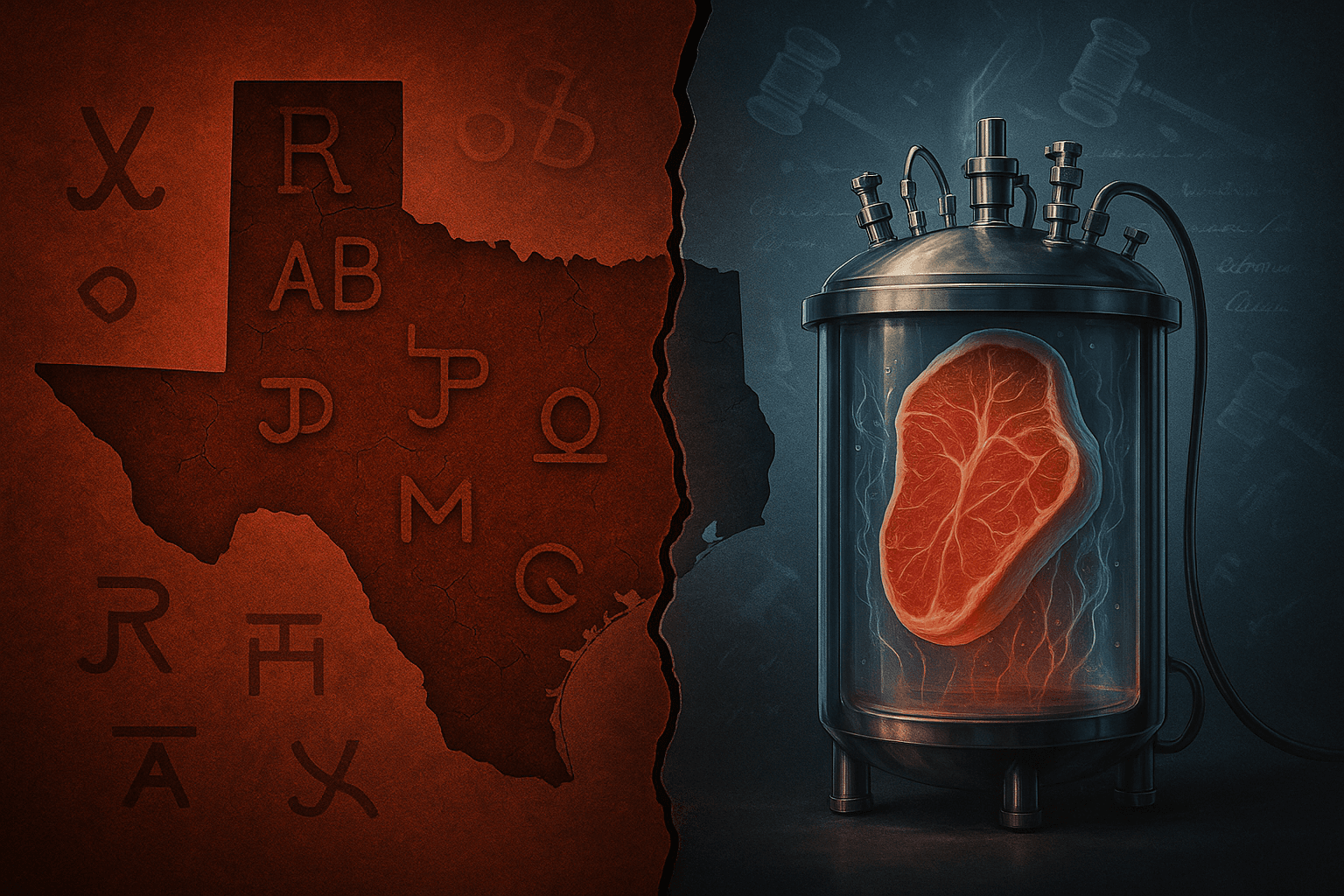

As the GLP-1 gold rush enters its most aggressive phase, a bidding war for a small New York biotech has morphed into a live test of how deal terms can shape competition as much as science.

Pfizer has hauled Novo Nordisk and obesity-drug upstart Metsera into court, alleging that Novo’s higher offer for the biotech is less about closing a transaction and more about freezing a rival pipeline. In dueling filings in Delaware state and federal courts, Pfizer argues Novo structured its bid with a 30-month “outside date” and restrictive interim covenants that would slow Metsera’s clinical progress and protect Wegovy and Ozempic from a nascent competitor. Novo and Metsera reject the claims as “absurd” and “nonsense,” respectively. A Chancery Court hearing is set for Tuesday.

Novo says it is “confident” the proposed takeover poses no antitrust problem in a market now crowded with large-cap contenders. It publicly tabled an offer worth up to roughly $8.5–$9 billion—reports vary—with $6–$6.5 billion paid upfront, topping Pfizer’s deal valued up to $7.3 billion (including milestones). Metsera’s board has deemed Novo’s bid “superior,” triggering a four-day window for Pfizer to counter.

Table of Contents

ToggleWhat makes Metsera so coveted

Metsera’s lead asset, MET-097i, is a once-monthly GLP-1 injectable—positioned, if data hold, to match weekly injectables on weight loss with fewer injections. In late September, the company reported up to 14.1% placebo-adjusted weight loss at the highest dose after 28 weeks, with a tolerability profile Metsera says can support monthly dosing and a clear path to late-stage trials. Analysts peg the pipeline’s peak sales potential north of $5 billion. A second candidate, MET-233i, targets amylin for combination approaches.

That proposition lands precisely where big pharma wants to be: more convenient regimens that sustain efficacy. Pfizer’s own oral GLP-1 push has faltered—danuglipron was discontinued in April after a potential drug-induced liver injury—raising the strategic value of buying into a differentiated GLP-1 program that could slot into global primary-care scale.

The missed angle: deal mechanics as competitive weapons

The core of Pfizer’s case isn’t simply “we bid first.” It’s the specific architecture of Novo’s rival proposal.

- A long outside date: Pfizer says Novo’s deal is built to stall rather than close—a 30-month outside date versus Pfizer’s nine-month timeline that already received early termination of antitrust review on Oct. 31. If true, that is a long time for a direct competitor to sit atop a target’s strategic options.

- Interim operating covenants: Competitor deals often include strict “ordinary course” and information-sharing limits to avoid gun-jumping. Pfizer alleges Novo’s terms would be unusually restrictive, curbing trial starts and program acceleration—effectively “starve the rival, then own it.” Novo and Metsera deny the characterization.

- A controversial cash structure: Reporting indicates Novo’s bid includes a large upfront payment and a special dividend to Metsera holders at signing—even if the deal is later terminated. That unusual “pay-to-wait” design is marketed as risk insurance against regulatory delay; Pfizer calls it unlawful and anticompetitive. Regardless of who’s right in law, it’s a notable innovation in pharma M&A that could become a template in crowded therapeutic arenas.

If Pfizer’s “stall-and-starve” theory resonates with judges or regulators, it could influence future “killer acquisition” debates in therapeutics where a dominant incumbent buys an emerging challenger before pivotal data readouts. Novo counters that obesity care is already intensely competitive—Eli Lilly’s Zepbound/Mounjaro loom—and that its bid reflects ordinary course M&A, not a plan to sideline a rival.

Why antitrust officials will care now

Two things have changed since the last GLP-1 land grab. First, the obesity market is projected to reach ~$150 billion annually, making even small share shifts material to payers and patients. Second, US merger review has toughened in process and posture—and early termination of routine HSR filings has only recently resumed after a years-long pause. That makes Pfizer’s point about its own swift clearance—and Novo’s elongated timeline—more salient than it might have been in 2021–2023.

Add one more variable: governance flux at Novo. In October, its controlling foundation moved to take firm control of the board amid a strategy reset focused on the US market. That conviction to move fast may be why Novo is willing to fight—legally and financially—for Metsera now.

Markets have already cast a vote

Metsera listed in February and has since roughly doubled in value, with a recent spike when the bidding surfaced. As the legal skirmish intensified on Monday, Metsera’s shares dipped ~3.7% to $60.73, Novo eased slightly, and Pfizer was flat—hardly a panic, but a sign investors see real paths for each party: Novo as the consolidator defending a franchise; Pfizer as the would-be entrant with court leverage; Metsera as a valuable asset either way.

The science risk that underpins the whole fight

All of the lawyering sits atop clinical risk. Metsera still has to reproduce mid-stage efficacy, manage GI tolerability at monthly dosing, and show durable weight loss without safety surprises in larger, longer trials. The 14.1% top-dose number is impressive but must hold up beyond 28 weeks and across broader populations. If outcomes fall short, today’s eye-popping bid math will look rich in hindsight.

The investor read: what to watch next

- Tuesday’s hearing in Delaware Chancery. Judges there are quick studies on deal-term intent. A ruling on temporary relief—e.g., limits on Metsera’s ability to switch to Novo—would signal how seriously the court takes Pfizer’s “stalling” theory.

- Regulatory choreography. Pfizer says its deal already cleared HSR early; Novo argues its own bid raises no antitrust issues given a crowded field. If the FTC or DOJ demands more information—or signals concern about a dominant GLP-1 incumbent buying into monthly dosing—expect the legal narrative to turn on competition remedies.

- Clinical catalysts. Watch for Metsera’s Phase 3 design and any head-to-head or add-on plans (e.g., GLP-1 + amylin). If management starts spending like a company that expects to remain independent (or Pfizer-owned), that behavior will be scrutinized against interim covenants at the heart of the suits.

- Read-through to smaller players. Shares of Viking, Structure and Altimmune moved on the bidding headlines. If courts or regulators frown on “stall-and-starve” structures, mid-cap obesity names could see higher take-out premia as incumbents avoid overly restrictive designs.

The bottom line

This is not just a rich bidding war for a buzzy obesity biotech. It is a referendum on how far a dominant drugmaker can go in using timelines and covenants—the quieter levers of M&A—to protect a franchise while absorbing a challenger. The decision path now runs through Delaware courtrooms and Washington antitrust offices as much as it does through endocrinology clinics. If Pfizer convinces a judge that Novo’s proposal is a moat disguised as a merger, it could redraw the lines for pharma dealmaking in red-hot therapeutic markets. If Novo prevails, the message will be that price and strategic logic still rule—so long as patients ultimately get better drugs, faster.

Either way, the outcome will echo beyond Metsera. The GLP-1 giants are no longer just competing on molecules. They are competing on deal architecture—and investors should price that in.